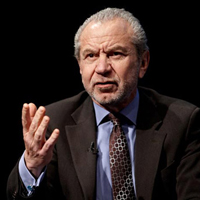

Lord Sugar, who was the previous government's enterprise champion, said in a debate in the House of Lords that an across-the-board rise in capital gains tax would depress the desire of people to work hard.

“It will have a devastating effect on enterprising people’s desire to take the lead and set up their own businesses with a view of either floating them or selling them by way of a trade sale,” said Lord Sugar.

an across-the-board rise in capital gains tax would depress the desire of people to work hard

“There is a £2m entrepreneurial relief currently in place but in this day and age this amount falls short of the aspirations of growth companies.”

Capital gains tax is currently charged at 18% but proposals put forward by the Liberal Democrats and included in the coalition deal could mean the levy is increased to the same levels as income tax. For a higher-rate taxpayer this could mean they pay the tax at 40%.

The government is widely expected to incorporate substantial climbdowns to the original CGT proposals in Tuesday’s Budget, including exemptions for entrepreneurs and a degree of taper relief.

To read the business advice of Lord Sugar’s right-hand woman, Karren Brady, please click here